XRP Trading Predictions

1 Day Prediction

Target: April 20, 2025$2.075

$2.078

$2.09

$2.06

Description

The price is expected to stabilize around 2.075 due to recent support at 2.060. RSI indicates neutral momentum, while MACD shows a slight bullish crossover. Volume remains low, suggesting limited volatility.

Analysis

XRP-USD has shown a bearish trend over the past month, with significant support at 2.060. Technical indicators like RSI are neutral, while MACD suggests potential upward movement. Volume has decreased, indicating lower trading interest.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or macroeconomic factors, potentially impacting the price.

1 Week Prediction

Target: April 27, 2025$2.05

$2.075

$2.07

$2.03

Description

Expect a slight decline to 2.050 as bearish sentiment persists. The recent downtrend and resistance at 2.090 may limit upward movement. Volume is expected to remain low, indicating weak buying pressure.

Analysis

The stock has been in a bearish phase, with resistance at 2.090 and support around 2.030. Technical indicators show a lack of momentum, and volume patterns suggest reduced trading activity, which may lead to further declines.

Confidence Level

Potential Risks

Potential for sudden market shifts or news could lead to unexpected price movements.

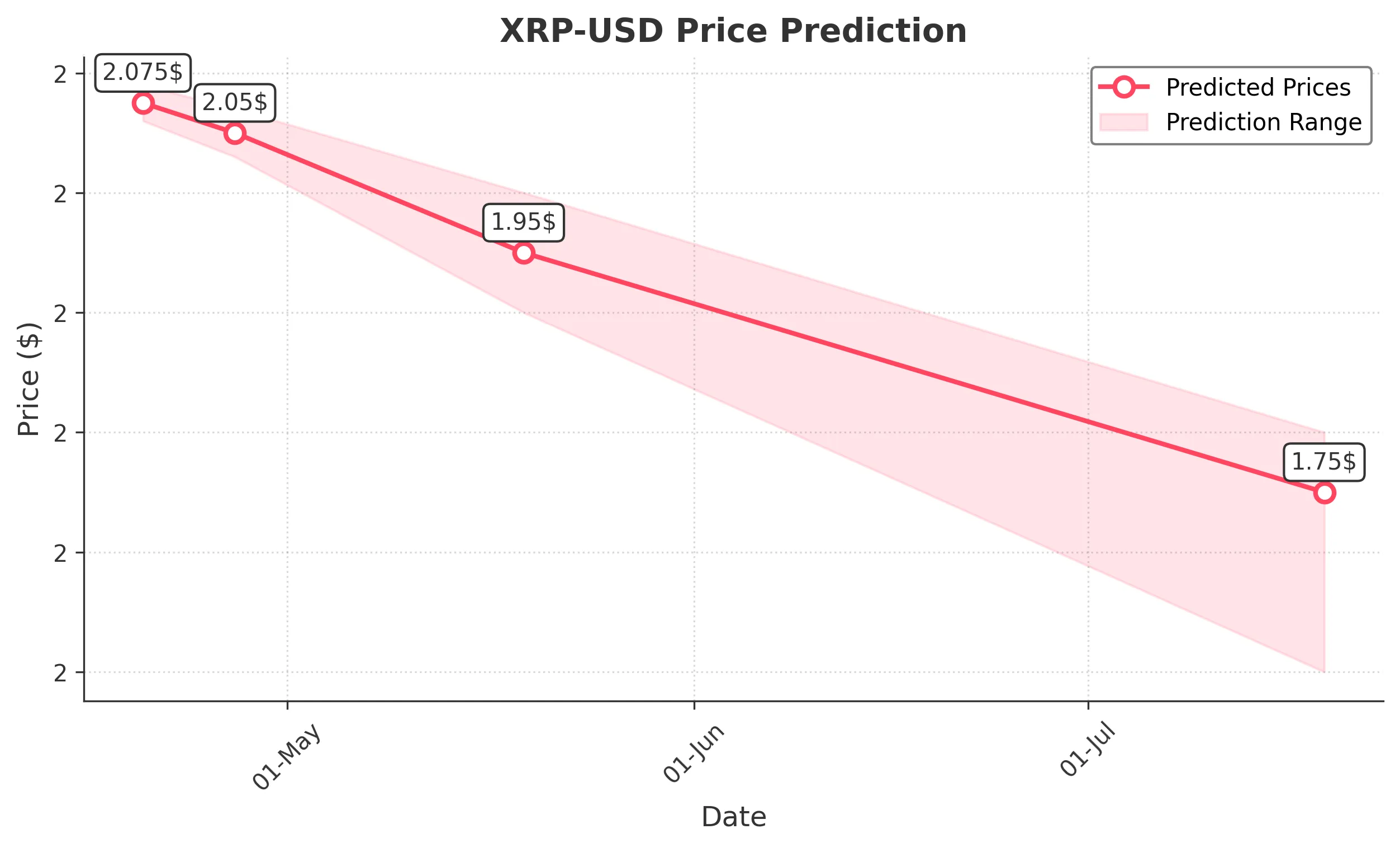

1 Month Prediction

Target: May 19, 2025$1.95

$2.05

$2

$1.9

Description

A continued bearish trend is anticipated, with a target close of 1.950. The MACD indicates a bearish crossover, and RSI suggests oversold conditions. Volume may increase as traders react to price movements.

Analysis

XRP-USD has been trending downward, with significant resistance at 2.090. The bearish sentiment is reinforced by technical indicators, and volume patterns indicate a lack of strong buying interest. Support levels are critical to watch.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price fluctuations.

3 Months Prediction

Target: July 19, 2025$1.75

$1.95

$1.8

$1.6

Description

A further decline to 1.750 is expected as bearish trends continue. The market sentiment remains negative, and technical indicators suggest further weakness. Volume may increase as traders react to market conditions.

Analysis

The overall trend for XRP-USD is bearish, with significant resistance levels and declining volume. Technical indicators suggest continued weakness, and external factors could exacerbate the downward trend. Support levels will be crucial.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could significantly impact the price.