XRP Trading Predictions

1 Day Prediction

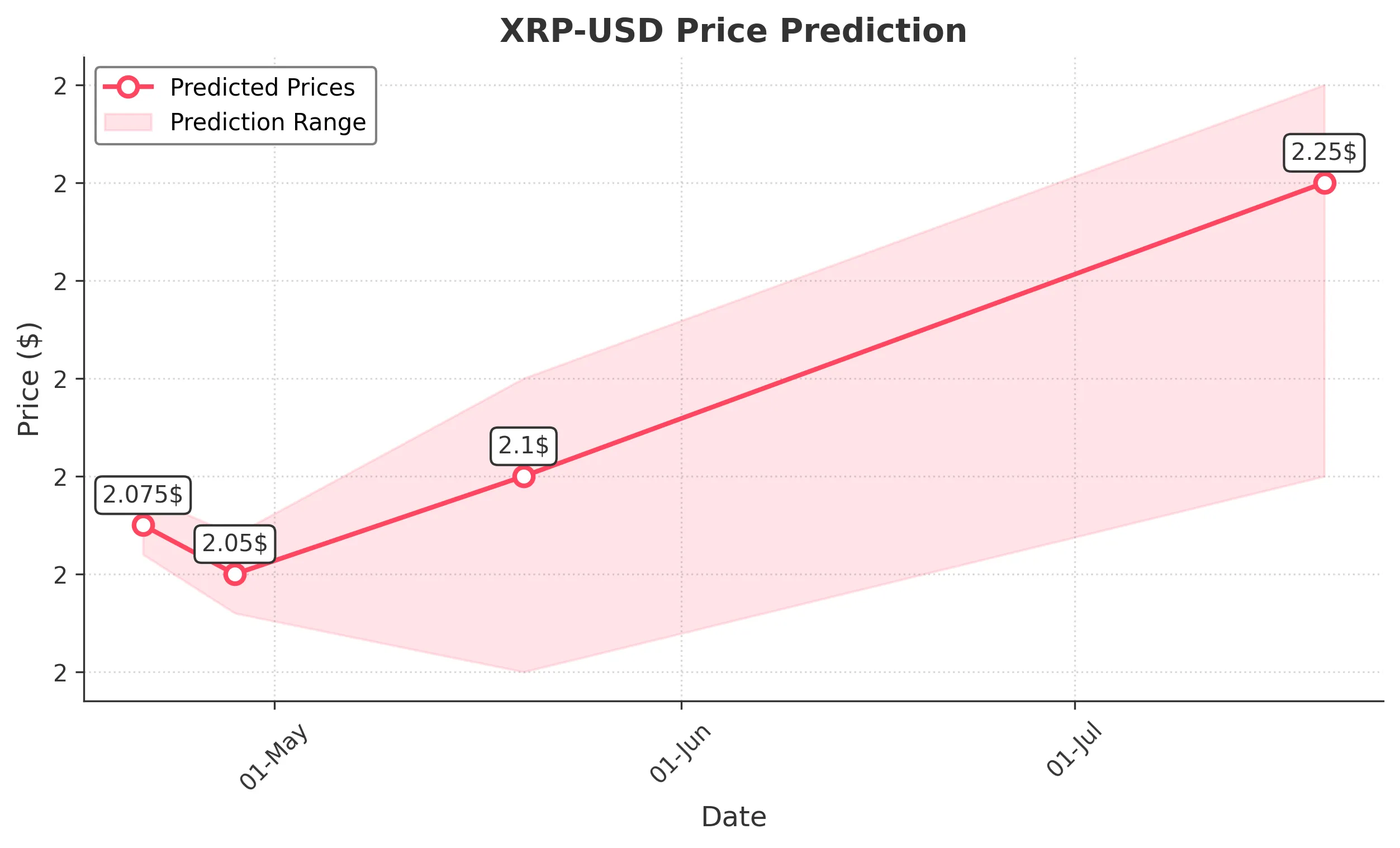

Target: April 21, 2025$2.075

$2.071

$2.09

$2.06

Description

The price is expected to stabilize around 2.075, with slight bullish momentum indicated by recent candlestick patterns. However, the RSI shows overbought conditions, suggesting potential resistance at 2.090.

Analysis

XRP has shown a bearish trend over the past month, with significant support around 2.060. The recent price action indicates a potential reversal, but the overall sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: April 28, 2025$2.05

$2.075

$2.07

$2.03

Description

A slight decline to 2.050 is anticipated as bearish signals from the MACD and RSI suggest weakening momentum. The price may test support at 2.030, with resistance at 2.070.

Analysis

The stock has been in a bearish phase, with recent lower highs and lower lows. Key support at 2.030 is critical, while resistance at 2.070 may limit upward movement. Volume has been decreasing, indicating waning interest.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could lead to increased volatility.

1 Month Prediction

Target: May 20, 2025$2.1

$2.05

$2.15

$2

Description

A potential recovery to 2.100 is expected as the market may react positively to upcoming news. The Bollinger Bands suggest a breakout could occur, with resistance at 2.150.

Analysis

The overall trend shows signs of stabilization after a bearish phase. The RSI is approaching neutral territory, indicating potential for upward movement. Key resistance levels will be crucial in determining the next direction.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, especially with regulatory developments.

3 Months Prediction

Target: July 20, 2025$2.25

$2.2

$2.3

$2.1

Description

A bullish outlook is projected for the next three months, with a target of 2.250. Positive market sentiment and potential regulatory clarity could drive prices higher, with key resistance at 2.300.

Analysis

The stock has shown a recovery pattern, with increasing volume and bullish candlestick formations. Support at 2.100 is critical, while the overall market sentiment appears to be shifting positively, suggesting potential for growth.

Confidence Level

Potential Risks

Long-term predictions are subject to market volatility and external economic factors.