XRP Trading Predictions

1 Day Prediction

Target: April 25, 2025$2.175

$2.17

$2.2

$2.15

Description

The price is expected to stabilize around 2.175 due to recent support at 2.165. RSI indicates neutral momentum, while MACD shows a slight bullish crossover. Volume remains moderate, suggesting consolidation.

Analysis

XRP-USD has shown a bearish trend recently, with significant support at 2.165. The RSI is neutral, indicating indecision, while MACD suggests a potential reversal. Volume has been decreasing, indicating a lack of strong buying interest.

Confidence Level

Potential Risks

Potential volatility due to market sentiment shifts or macroeconomic news could impact the prediction.

1 Week Prediction

Target: May 2, 2025$2.15

$2.175

$2.18

$2.12

Description

Expect a slight decline to 2.150 as bearish sentiment persists. The Bollinger Bands indicate tightening, suggesting potential volatility. The recent downtrend may continue unless a bullish catalyst emerges.

Analysis

The stock has been in a bearish phase, with resistance at 2.200. The ATR indicates low volatility, while the RSI is approaching oversold territory, hinting at a possible bounce. However, the overall trend remains downward.

Confidence Level

Potential Risks

Market sentiment and external news could lead to unexpected price movements, affecting the accuracy of this prediction.

1 Month Prediction

Target: May 24, 2025$2.1

$2.15

$2.15

$2.05

Description

A further decline to 2.100 is anticipated as bearish momentum continues. The Fibonacci retracement levels suggest support around 2.100, but without strong buying pressure, a drop below this level is possible.

Analysis

XRP-USD has been trending downward, with key support at 2.100. The MACD is bearish, and the RSI indicates oversold conditions. Volume spikes have been observed, but they have not translated into sustained upward movement.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could significantly alter the price trajectory, leading to potential inaccuracies.

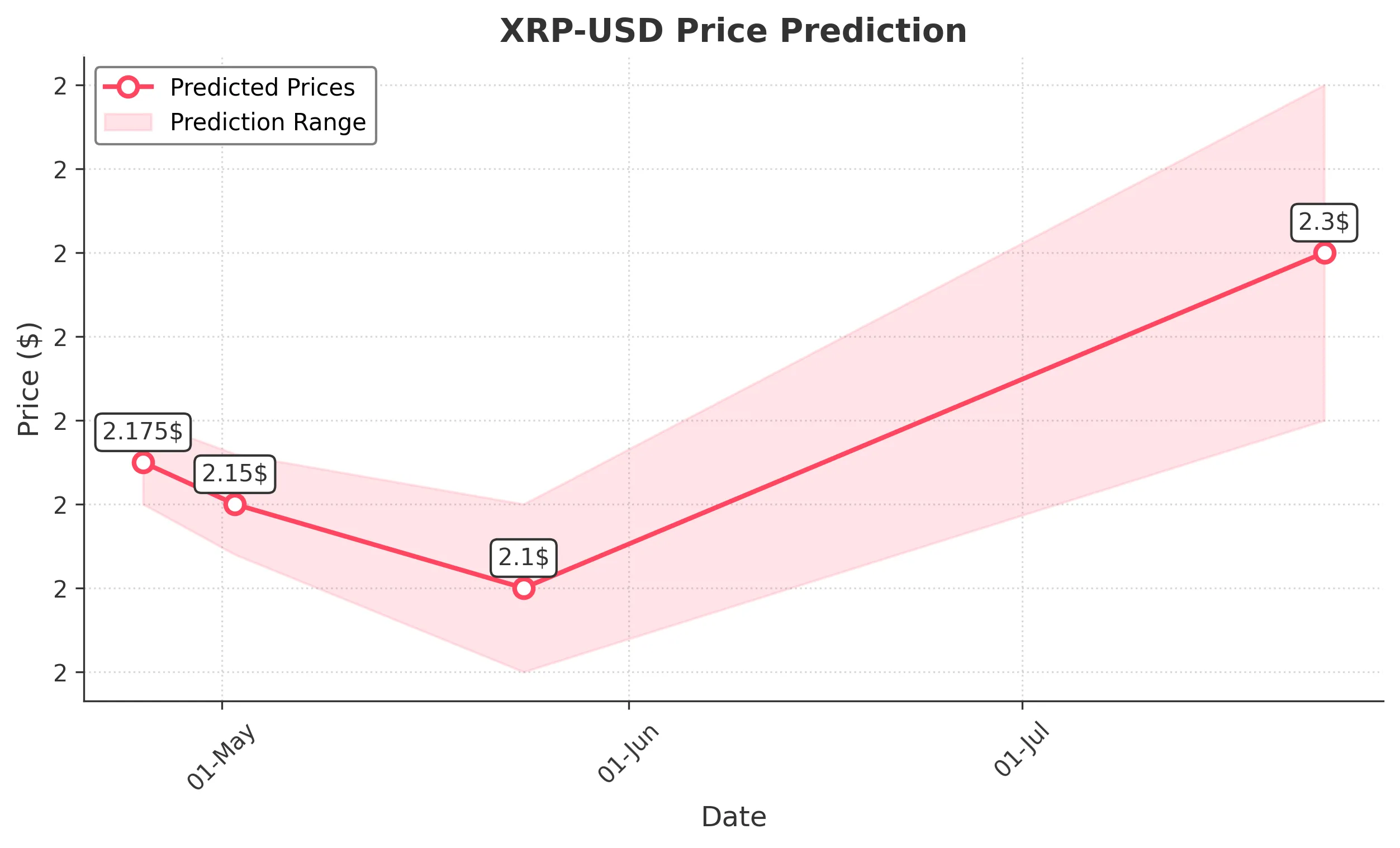

3 Months Prediction

Target: July 24, 2025$2.3

$2.25

$2.4

$2.2

Description

A recovery to 2.300 is projected as market sentiment may shift positively. If bullish momentum builds, we could see a breakout above 2.400, supported by improved volume and potential positive news.

Analysis

The long-term outlook shows potential for recovery, with resistance at 2.400. The RSI may recover from oversold levels, and if volume increases, it could signal a bullish reversal. However, caution is warranted due to recent bearish trends.

Confidence Level

Potential Risks

The prediction relies on market recovery; any negative news could reverse this trend, leading to lower prices.