XRP Trading Predictions

1 Day Prediction

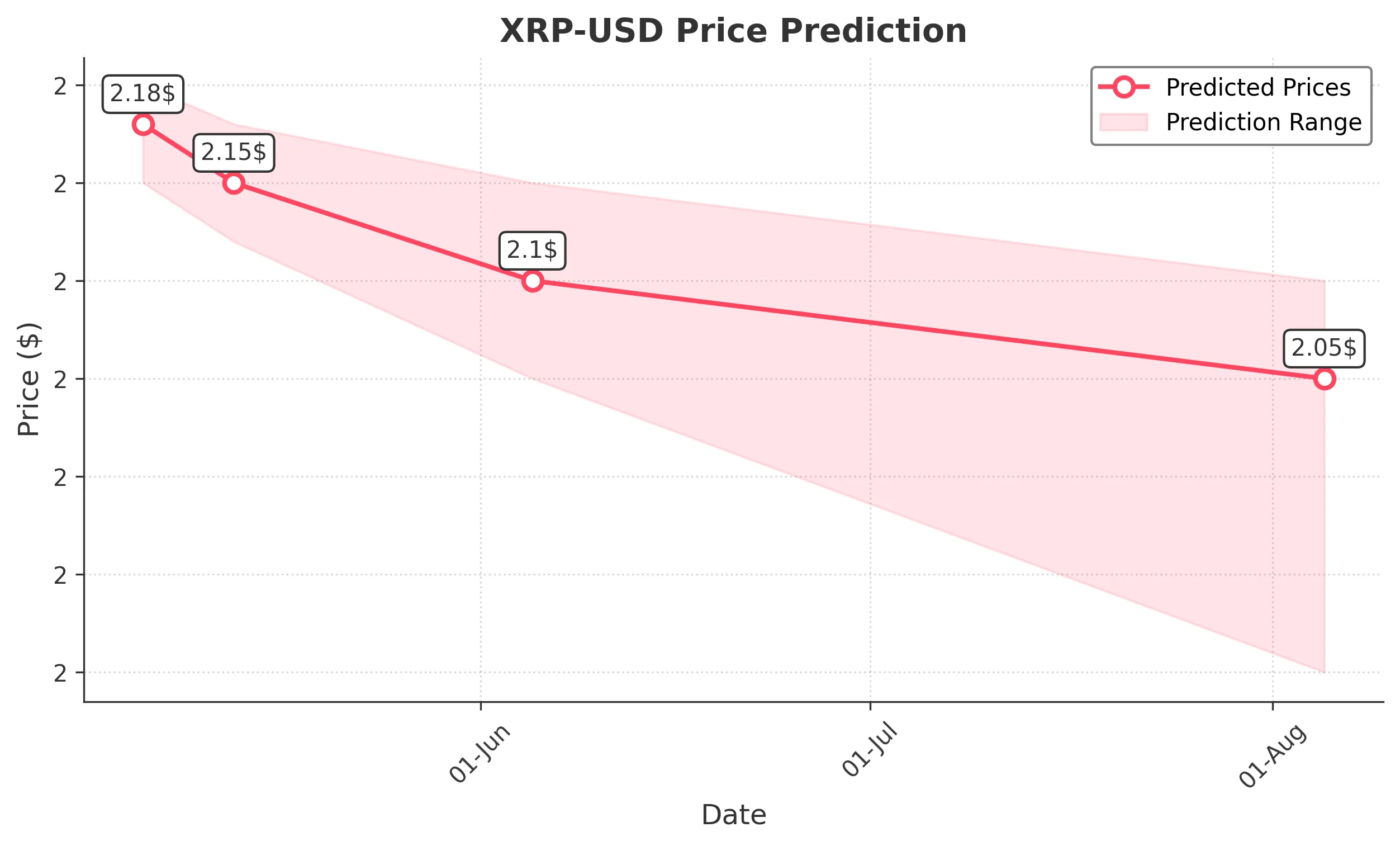

Target: May 6, 2025$2.18

$2.174

$2.2

$2.15

Description

The price is expected to stabilize around 2.18, supported by recent bullish momentum. RSI indicates neutrality, while MACD shows a slight bullish crossover. However, volatility remains a concern due to recent fluctuations.

Analysis

XRP has shown a bearish trend recently, with significant support at 2.15. The RSI is neutral, indicating potential for both upward and downward movements. Volume has decreased, suggesting a lack of strong conviction in either direction.

Confidence Level

Potential Risks

Market sentiment could shift quickly, especially with external news affecting crypto markets.

1 Week Prediction

Target: May 13, 2025$2.15

$2.18

$2.18

$2.12

Description

Expect a slight decline to 2.15 as bearish sentiment may prevail. The recent downtrend and lower highs suggest a potential continuation. Watch for volume spikes that could indicate reversals.

Analysis

The past week has shown a bearish trend with resistance at 2.18. The MACD is bearish, and the ATR indicates increasing volatility. Volume has been low, suggesting a lack of strong buying interest.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could impact prices significantly.

1 Month Prediction

Target: June 5, 2025$2.1

$2.15

$2.15

$2.05

Description

A further decline to 2.10 is anticipated as bearish trends continue. The RSI indicates oversold conditions, but without strong buying pressure, a rebound may be limited. Watch for potential support at 2.05.

Analysis

XRP has been in a bearish phase, with significant resistance at 2.15. The MACD is showing bearish momentum, and the ATR suggests increased volatility. Volume patterns indicate a lack of strong buying interest.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price movements.

3 Months Prediction

Target: August 5, 2025$2.05

$2.1

$2.1

$1.9

Description

Expect a continued downtrend to 2.05, with potential lows around 1.90. The bearish sentiment is strong, and without significant market catalysts, further declines are likely.

Analysis

The overall trend remains bearish, with key support at 2.00. The RSI indicates oversold conditions, but without strong buying pressure, a rebound may be limited. Volume has been decreasing, indicating a lack of conviction.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential regulatory changes and market sentiment shifts.