XRP Trading Predictions

1 Day Prediction

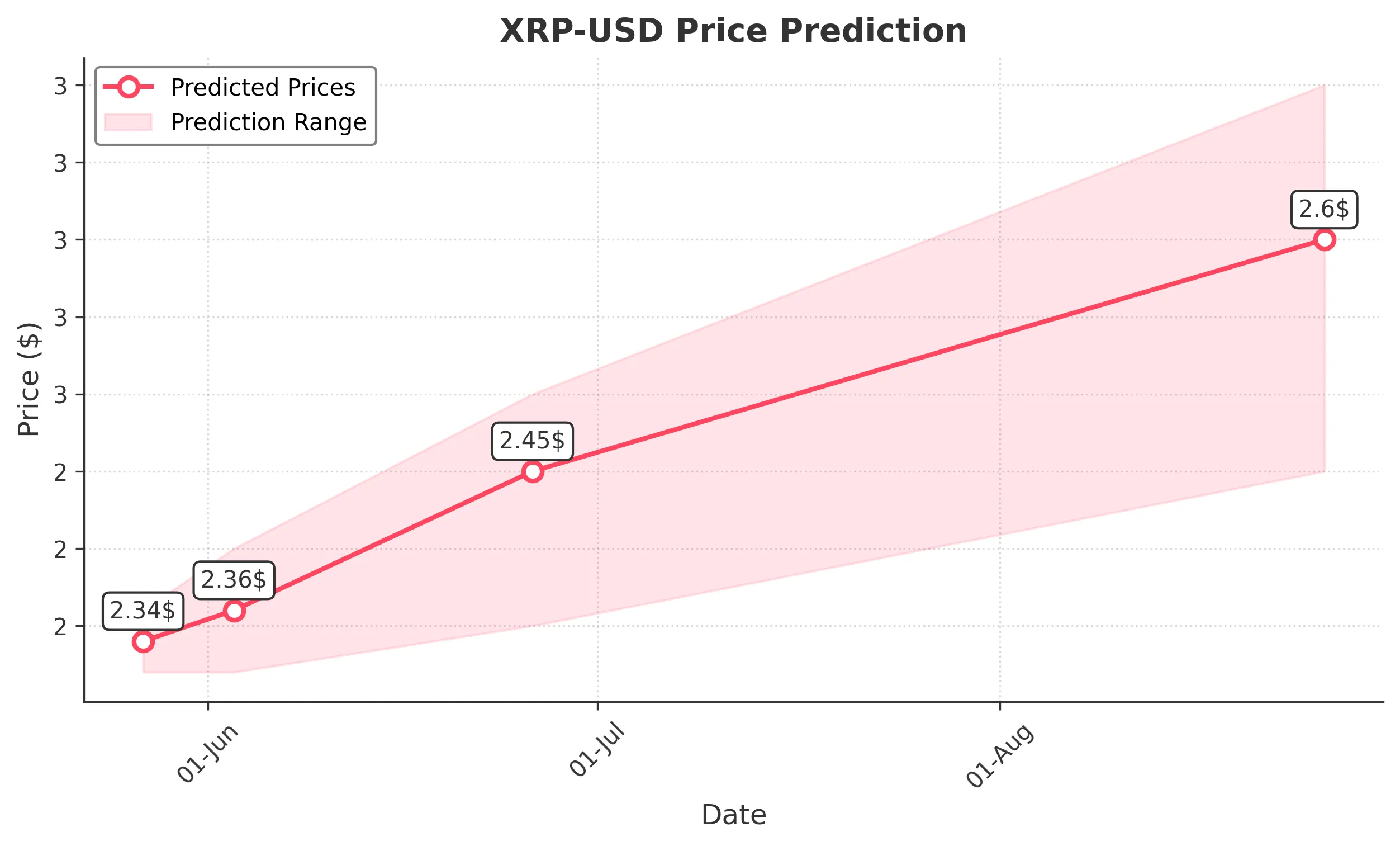

Target: May 27, 2025$2.34

$2.34

$2.36

$2.32

Description

The price is expected to stabilize around 2.34, supported by recent bullish momentum and a slight upward trend in volume. RSI indicates neutrality, suggesting potential for a minor upward move.

Analysis

XRP has shown a bullish trend recently, with support around 2.30 and resistance at 2.40. The RSI is neutral, indicating potential for both upward and downward movements. Volume has been consistent, but spikes could indicate volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact short-term price movements.

1 Week Prediction

Target: June 3, 2025$2.36

$2.34

$2.4

$2.32

Description

A slight upward trend is anticipated as the market sentiment remains cautiously optimistic. The MACD shows bullish divergence, and the price is approaching a Fibonacci retracement level.

Analysis

The past week has seen XRP fluctuating around 2.34-2.36, with resistance at 2.40. The MACD indicates bullish momentum, but the RSI is nearing overbought territory, suggesting caution.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend.

1 Month Prediction

Target: June 26, 2025$2.45

$2.36

$2.5

$2.35

Description

Expecting a gradual increase in price as bullish sentiment builds. The 50-day moving average is trending upwards, and recent volume spikes suggest increased interest.

Analysis

XRP has been in a bullish phase, with key support at 2.30 and resistance at 2.50. The moving averages indicate a positive trend, while the ATR suggests moderate volatility.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may influence price.

3 Months Prediction

Target: August 26, 2025$2.6

$2.45

$2.7

$2.45

Description

Long-term bullish outlook as XRP continues to gain traction. The overall market sentiment is positive, and technical indicators support upward movement.

Analysis

XRP has shown resilience with a bullish trend over the past months. Key support is at 2.40, while resistance is at 2.70. The market sentiment is generally positive, but external factors could introduce volatility.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic changes and regulatory news.