XRP Trading Predictions

1 Day Prediction

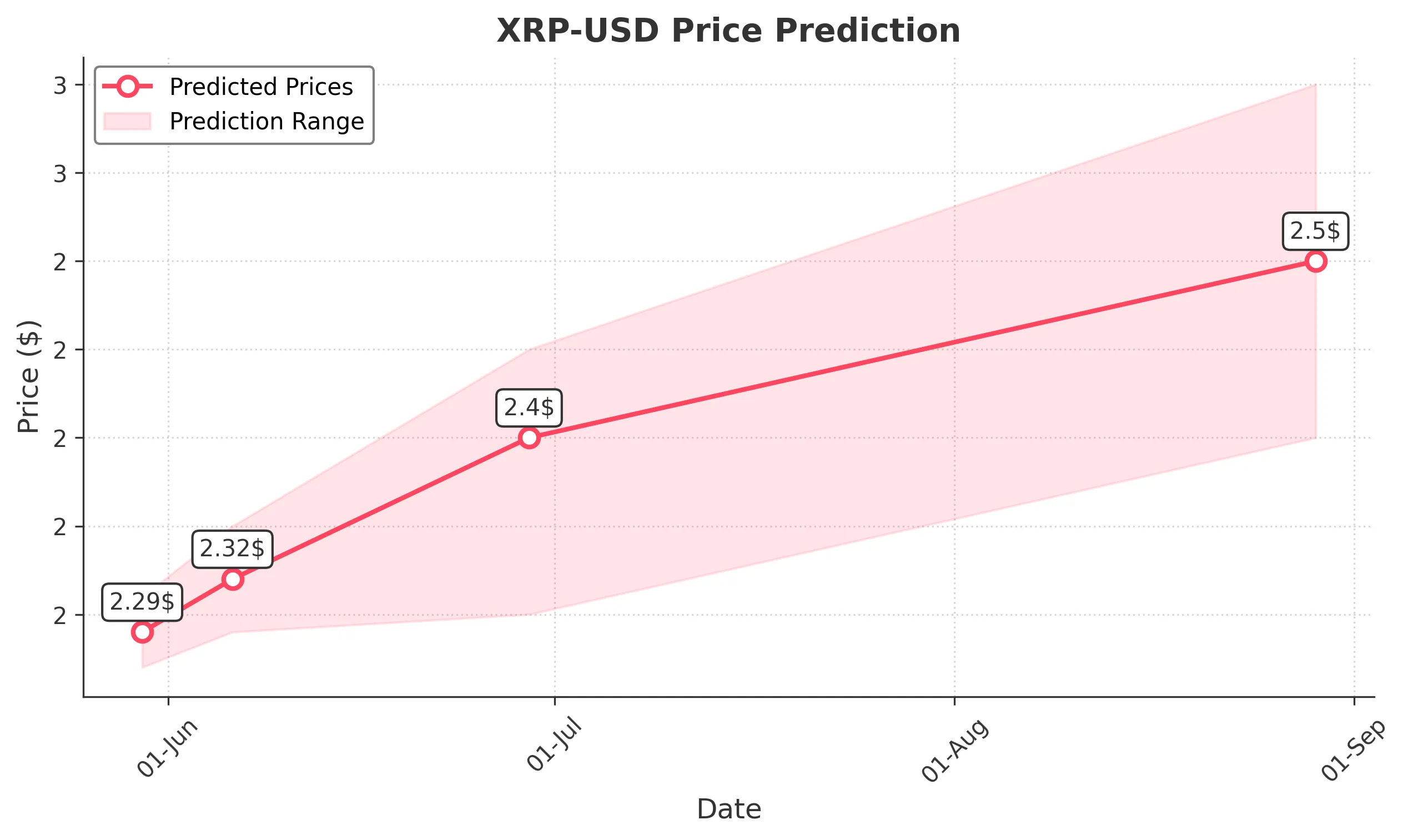

Target: May 30, 2025$2.29

$2.286

$2.31

$2.27

Description

The price is expected to stabilize around 2.29, supported by recent bullish momentum and a slight upward trend in volume. RSI indicates neutrality, suggesting potential for a minor upward move.

Analysis

XRP has shown a sideways trend recently, with support around 2.27 and resistance at 2.35. The RSI is neutral, indicating no strong momentum. Volume has been decreasing, suggesting a potential consolidation phase.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction, especially if there are sudden shifts in sentiment.

1 Week Prediction

Target: June 6, 2025$2.32

$2.29

$2.35

$2.29

Description

A slight bullish trend is anticipated as the market sentiment improves. The MACD shows a potential crossover, indicating upward momentum. However, resistance at 2.35 may limit gains.

Analysis

The past week has shown a slight bullish trend, with key support at 2.27. The MACD is approaching a bullish crossover, while the ATR indicates moderate volatility. Volume remains stable but could increase with positive news.

Confidence Level

Potential Risks

Potential bearish reversals could occur if market sentiment shifts or if macroeconomic factors negatively impact trading.

1 Month Prediction

Target: June 29, 2025$2.4

$2.32

$2.45

$2.3

Description

Expecting a gradual increase in price as bullish sentiment builds. Fibonacci retracement levels suggest 2.40 as a target, but resistance at 2.45 may pose challenges.

Analysis

XRP has been in a consolidation phase, with resistance at 2.45 and support at 2.27. The RSI is approaching overbought territory, indicating potential for a pullback. Volume trends suggest cautious optimism.

Confidence Level

Potential Risks

Market conditions are unpredictable; any negative news could reverse the trend. Watch for volume spikes that may indicate shifts.

3 Months Prediction

Target: August 29, 2025$2.5

$2.4

$2.6

$2.4

Description

Long-term bullish outlook as market sentiment improves. Technical indicators suggest a breakout above 2.50, but macroeconomic factors could introduce volatility.

Analysis

Over the past three months, XRP has shown a mixed performance with periods of volatility. Key resistance at 2.50 and support at 2.27 are critical. The MACD indicates potential bullish momentum, but external factors could lead to fluctuations.

Confidence Level

Potential Risks

Unforeseen regulatory changes or market downturns could impact this prediction significantly. Monitor global economic indicators closely.