XRP Trading Predictions

1 Day Prediction

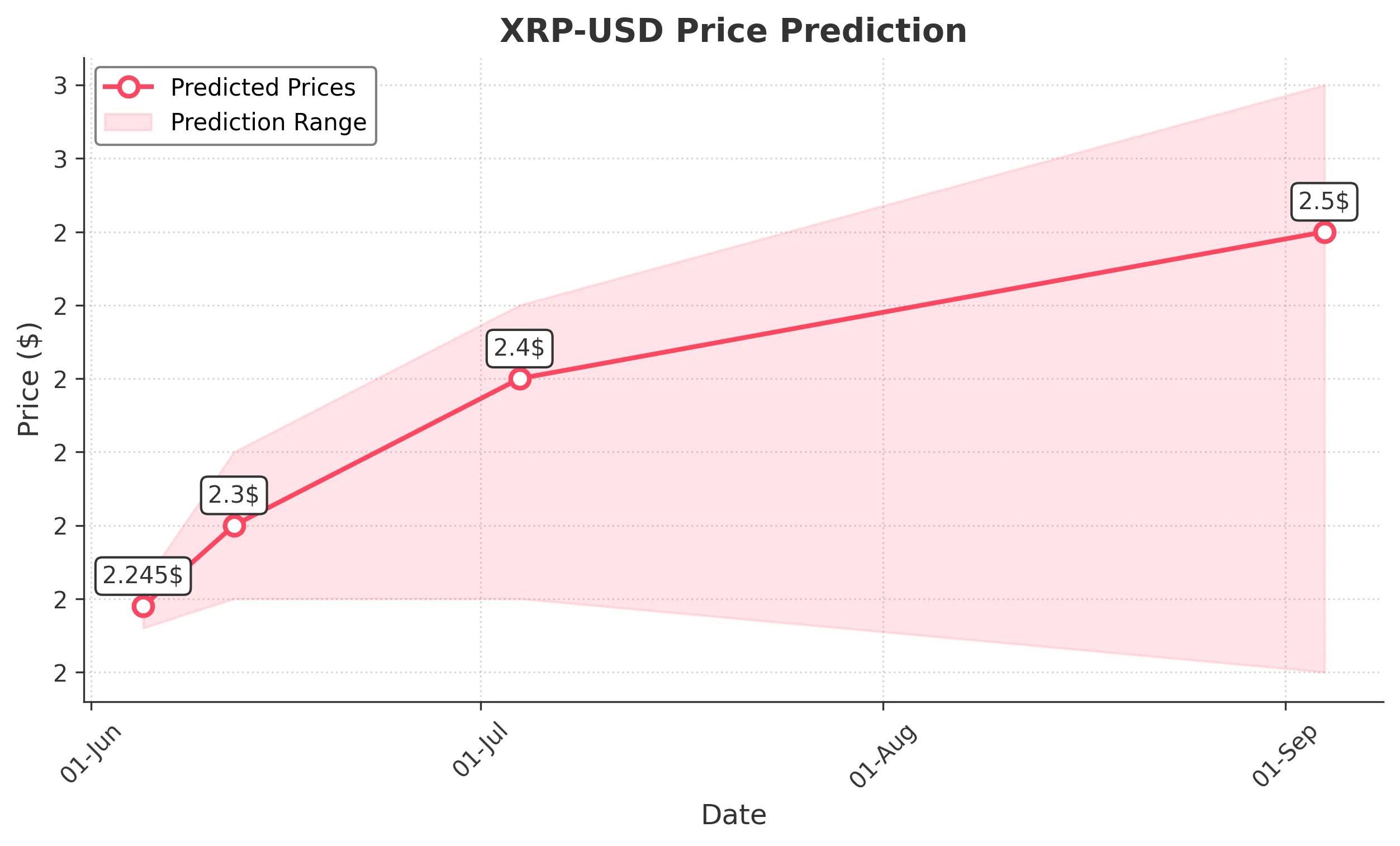

Target: June 5, 2025$2.245

$2.24

$2.26

$2.23

Description

The price is expected to stabilize around 2.245, supported by recent bullish momentum and a slight upward trend in the last few days. RSI indicates neutrality, while MACD shows a potential bullish crossover. Volume remains moderate, suggesting steady interest.

Analysis

XRP has shown a bullish trend recently, with key support at 2.230 and resistance at 2.260. The RSI is neutral, indicating no overbought or oversold conditions. Volume has been consistent, but any sudden market news could lead to volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: June 12, 2025$2.3

$2.245

$2.35

$2.25

Description

A slight upward trend is anticipated as the market sentiment remains cautiously optimistic. The recent bullish candlestick patterns support this, but the RSI nearing overbought territory could signal a pullback.

Analysis

The past week has shown a bullish trend with increasing volume. Key resistance is at 2.350, while support is at 2.250. The MACD is bullish, but caution is advised as the RSI approaches overbought levels.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could lead to price fluctuations.

1 Month Prediction

Target: July 4, 2025$2.4

$2.3

$2.45

$2.25

Description

The price is expected to rise to 2.400, driven by positive market sentiment and potential bullish patterns. However, the RSI indicates a risk of overextension, suggesting a possible correction.

Analysis

XRP has been in a bullish phase, with key support at 2.250 and resistance at 2.450. The MACD is bullish, but the RSI indicates potential overbought conditions. Volume trends are positive, but caution is warranted.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and external factors may lead to unexpected price movements.

3 Months Prediction

Target: September 4, 2025$2.5

$2.4

$2.6

$2.2

Description

A longer-term bullish outlook is anticipated, with the price potentially reaching 2.500. However, the market may face resistance at 2.600, and any negative news could lead to a significant pullback.

Analysis

The overall trend appears bullish, but significant resistance is expected at 2.600. The RSI may indicate overbought conditions, and external factors could lead to volatility. Volume patterns suggest steady interest, but caution is advised.

Confidence Level

Potential Risks

Long-term predictions are inherently uncertain, especially with potential regulatory changes and market volatility.