XRP Trading Predictions

1 Day Prediction

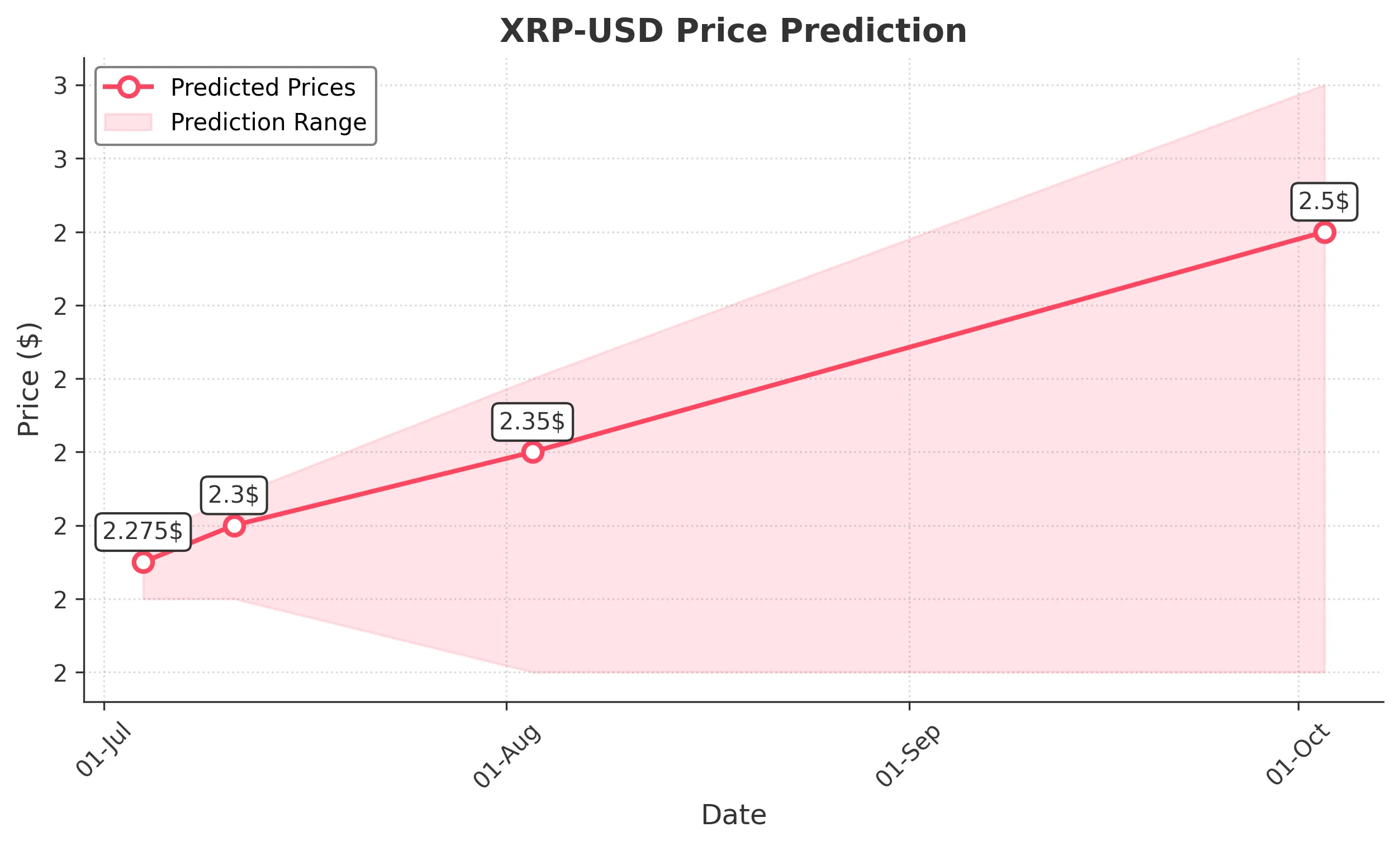

Target: July 4, 2025$2.275

$2.27

$2.29

$2.25

Description

The price is expected to rise slightly due to bullish momentum observed in the last few days, with the RSI indicating an upward trend. However, resistance at 2.290 may limit gains.

Analysis

XRP has shown a bullish trend recently, with key support at 2.200 and resistance at 2.290. The RSI is approaching overbought levels, indicating a possible pullback. Volume has been stable, suggesting sustained interest.

Confidence Level

Potential Risks

Potential volatility due to market sentiment and external news could impact the prediction.

1 Week Prediction

Target: July 11, 2025$2.3

$2.275

$2.32

$2.25

Description

A continued bullish trend is anticipated, supported by recent price action and positive market sentiment. However, the MACD shows signs of potential divergence, indicating caution.

Analysis

The stock has been trending upward, with a recent breakout above 2.250. The MACD is bullish, but the RSI is nearing overbought territory. Volume remains healthy, but any significant market shifts could lead to volatility.

Confidence Level

Potential Risks

Market corrections or negative news could reverse the trend, impacting the accuracy of this prediction.

1 Month Prediction

Target: August 3, 2025$2.35

$2.3

$2.4

$2.2

Description

The price is expected to trend upwards as bullish sentiment persists. Fibonacci retracement levels suggest support at 2.200, while resistance at 2.400 could be tested.

Analysis

XRP has shown resilience with a bullish trend. Key support at 2.200 and resistance at 2.400 are critical levels. The RSI indicates strength, but caution is warranted as the market may react to external factors.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could impact the price trajectory.

3 Months Prediction

Target: October 3, 2025$2.5

$2.35

$2.6

$2.2

Description

Long-term bullish outlook based on sustained upward momentum and positive market sentiment. However, potential resistance at 2.600 may pose challenges.

Analysis

The overall trend remains bullish, with key support at 2.200 and resistance at 2.600. The market sentiment is positive, but external factors could introduce volatility. The ATR indicates increasing volatility, suggesting caution.

Confidence Level

Potential Risks

Market volatility and regulatory changes could significantly affect the price, leading to potential corrections.