XRP Trading Predictions

1 Day Prediction

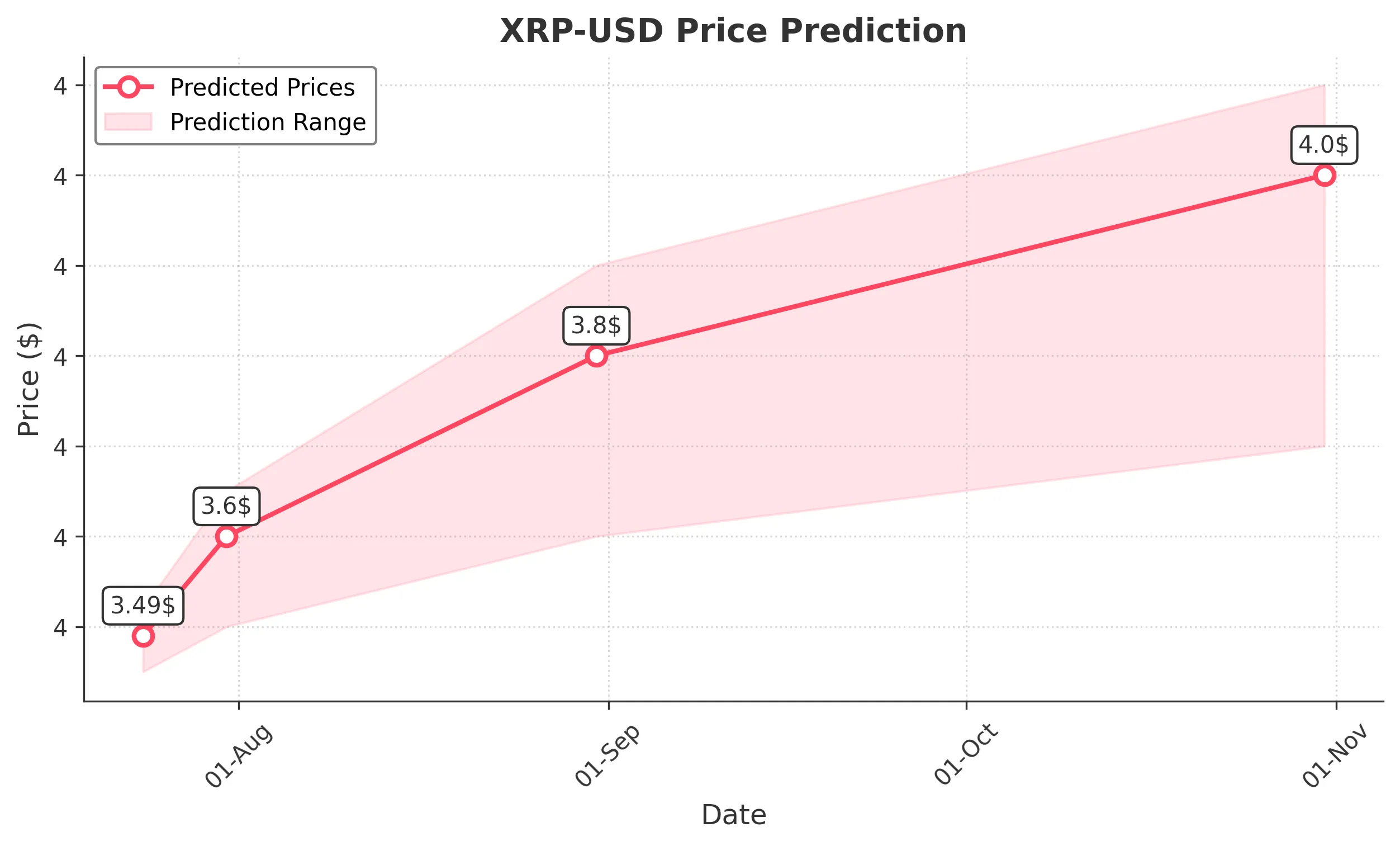

Target: July 24, 2025$3.49

$3.474413

$3.52

$3.45

Description

The price is expected to stabilize around 3.49, supported by recent bullish momentum and a strong close. RSI indicates overbought conditions, suggesting a potential pullback. Volume remains high, indicating strong interest.

Analysis

XRP has shown a bullish trend over the past three months, with significant upward movement. Key resistance at 3.55 and support around 3.40. Volume spikes indicate strong buying interest, but overbought conditions may lead to short-term corrections.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI levels and market sentiment shifts.

1 Week Prediction

Target: July 31, 2025$3.6

$3.49

$3.65

$3.5

Description

Expecting a continued bullish trend with a close around 3.60. The MACD shows bullish crossover, and the price is above the 20-day moving average. However, watch for potential resistance at 3.65.

Analysis

The stock has been in a strong uptrend, with significant volume supporting price increases. Key resistance at 3.65 may pose challenges. The MACD and moving averages suggest bullish momentum, but overbought conditions could lead to corrections.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could impact upward momentum.

1 Month Prediction

Target: August 31, 2025$3.8

$3.6

$3.9

$3.6

Description

Anticipating a bullish continuation towards 3.80, supported by strong market sentiment and technical indicators. Fibonacci retracement levels suggest potential resistance at 3.90.

Analysis

XRP has maintained a bullish trend, with significant support at 3.50. The RSI is approaching overbought territory, indicating potential corrections. Volume remains strong, but external factors could introduce volatility.

Confidence Level

Potential Risks

External market factors and regulatory news could impact price stability.

3 Months Prediction

Target: October 31, 2025$4

$3.8

$4.1

$3.7

Description

Expecting a bullish trend to continue, with a target close of 4.00. Market sentiment remains positive, but watch for potential resistance at 4.10. Volatility may increase as profit-taking occurs.

Analysis

The overall trend remains bullish, with key support at 3.70. The stock has shown resilience, but potential market corrections and external news could impact future performance. Volume patterns suggest strong interest, but caution is advised.

Confidence Level

Potential Risks

Market corrections and external economic factors could lead to unexpected price movements.