XRP Trading Predictions

1 Day Prediction

Target: July 25, 2025$3.12

$3.1

$3.2

$3.05

Description

The price is expected to stabilize after recent volatility. The RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 3.00 and bullish sentiment may keep prices elevated.

Analysis

XRP has shown a bullish trend over the past three months, with significant price increases. Key resistance at 3.55 and support at 3.00 are critical. The MACD is bullish, but RSI indicates overbought conditions, suggesting caution.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or macroeconomic factors, which may lead to unexpected price movements.

1 Week Prediction

Target: August 1, 2025$3.05

$3.1

$3.15

$2.9

Description

A slight correction is anticipated as profit-taking may occur. The Bollinger Bands indicate potential volatility, and the MACD shows signs of weakening momentum. Watch for support at 3.00.

Analysis

The stock has been on a bullish run, but recent high volumes and price spikes suggest a potential pullback. Key support at 3.00 and resistance at 3.55 remain crucial for future movements.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could impact prices significantly, leading to higher volatility.

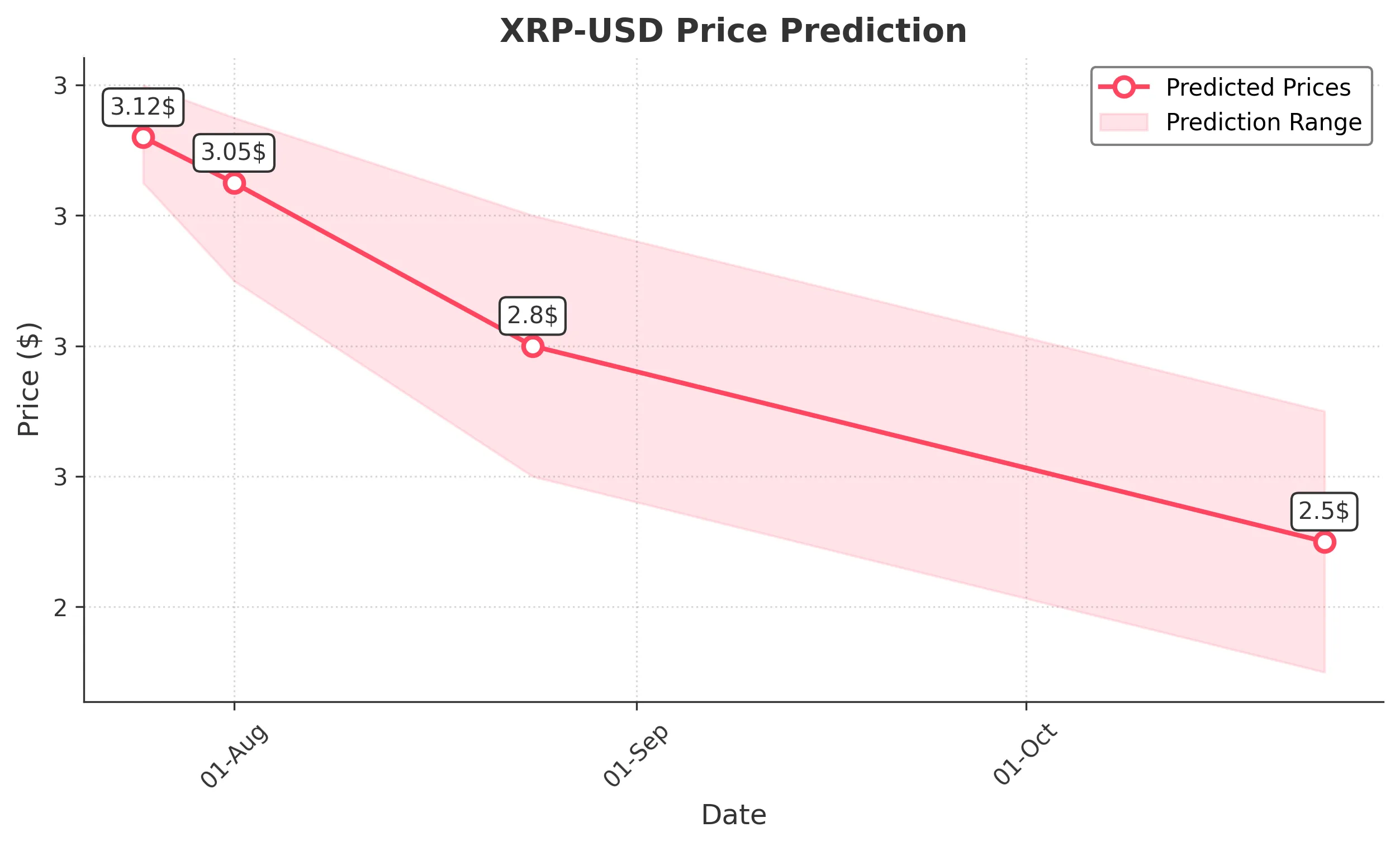

1 Month Prediction

Target: August 24, 2025$2.8

$2.95

$3

$2.6

Description

Expect a bearish trend as profit-taking and market corrections set in. The RSI is expected to drop, indicating oversold conditions. Watch for support at 2.70.

Analysis

The past three months have shown a strong bullish trend, but signs of exhaustion are emerging. Key support at 2.70 and resistance at 3.00 will be critical in determining future price action.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may lead to unexpected price movements.

3 Months Prediction

Target: October 24, 2025$2.5

$2.6

$2.7

$2.3

Description

A continued bearish trend is expected as market corrections take hold. The MACD may indicate a bearish crossover, and the RSI could remain low, suggesting further downside potential.

Analysis

The stock has experienced significant volatility, with a recent bullish trend. However, signs of a potential downturn are emerging, with key support at 2.30 and resistance at 3.00. Market sentiment remains cautious.

Confidence Level

Potential Risks

Potential regulatory changes or macroeconomic events could significantly impact the price, leading to volatility.