XRP Trading Predictions

1 Day Prediction

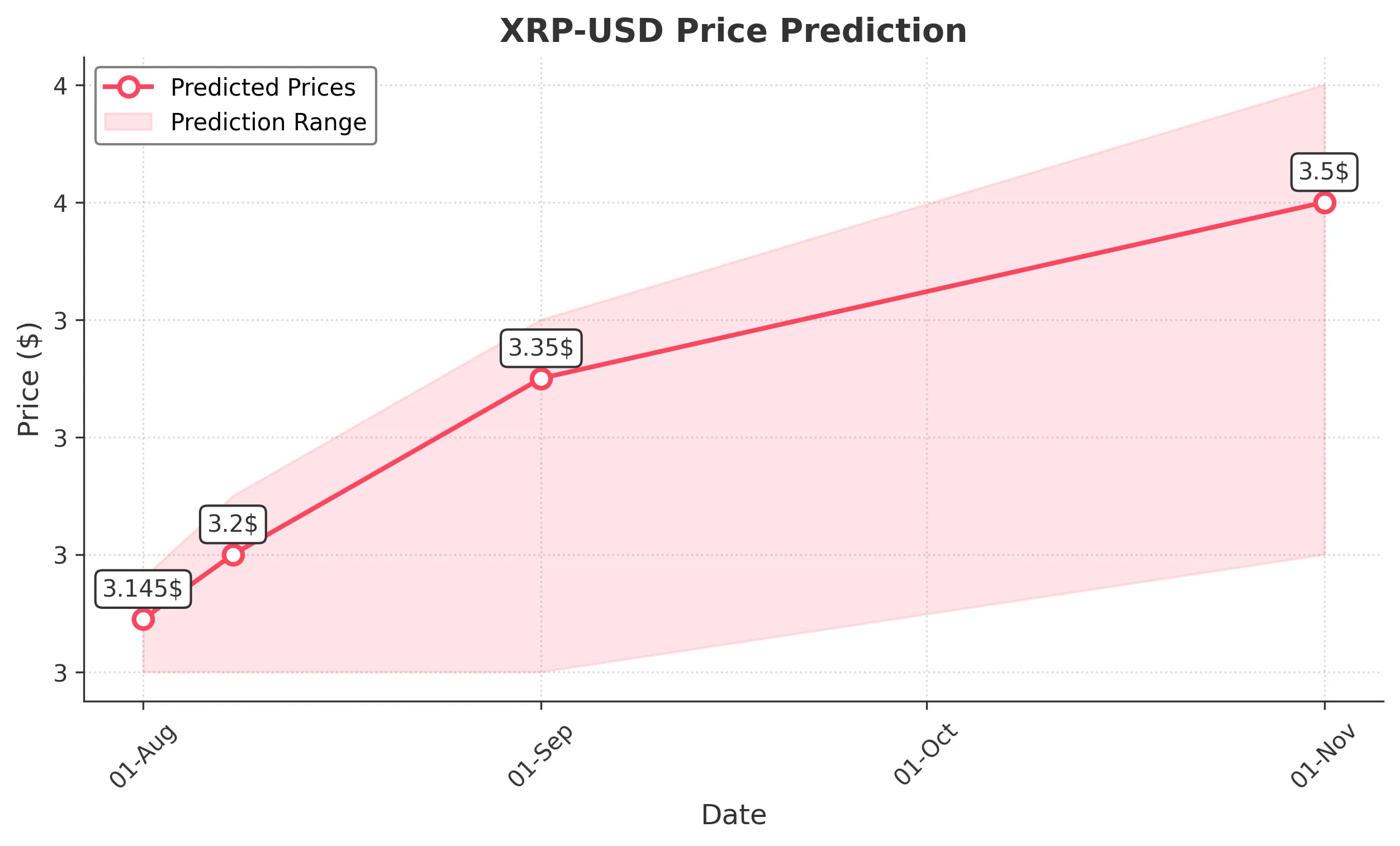

Target: August 1, 2025$3.145

$3.14

$3.18

$3.1

Description

The price is expected to stabilize around 3.145, supported by recent bullish momentum and a strong closing pattern. RSI indicates overbought conditions, suggesting a potential pullback. Volume remains high, indicating strong interest.

Analysis

XRP has shown a bullish trend over the past month, with significant support at 3.10 and resistance around 3.55. The recent price action indicates strong buying interest, but overbought RSI levels suggest caution.

Confidence Level

Potential Risks

Potential volatility due to market sentiment shifts or external news could impact the prediction.

1 Week Prediction

Target: August 8, 2025$3.2

$3.145

$3.25

$3.1

Description

Expect a gradual increase to 3.200 as bullish sentiment persists. The MACD shows a bullish crossover, and the price is above the 20-day moving average. However, watch for potential resistance at 3.25.

Analysis

The stock has been in a bullish phase, with strong volume spikes indicating increased interest. Key support at 3.10 and resistance at 3.25 are critical levels to monitor. The overall sentiment remains positive.

Confidence Level

Potential Risks

Market corrections or negative news could reverse the upward trend, impacting the forecast.

1 Month Prediction

Target: September 1, 2025$3.35

$3.2

$3.4

$3.1

Description

A bullish trend is expected to continue, with a target of 3.350. Fibonacci retracement levels support this upward movement. However, the RSI indicates potential overbought conditions, suggesting caution.

Analysis

XRP has shown strong upward momentum, with significant support at 3.10. The market sentiment is bullish, but overbought conditions could lead to short-term corrections. Monitoring external news is crucial.

Confidence Level

Potential Risks

Market volatility and external factors could lead to price corrections, affecting the accuracy of this prediction.

3 Months Prediction

Target: November 1, 2025$3.5

$3.35

$3.6

$3.2

Description

Long-term bullish outlook with a target of 3.500. The overall trend remains strong, but potential resistance at 3.60 could limit gains. Watch for market sentiment shifts that could impact this forecast.

Analysis

The stock has been in a strong bullish trend, but the potential for market corrections exists. Key support at 3.10 and resistance at 3.60 are critical. External factors and market sentiment will play a significant role in future performance.

Confidence Level

Potential Risks

Long-term predictions are subject to higher uncertainty due to market dynamics and potential regulatory changes.