XRP Trading Predictions

1 Day Prediction

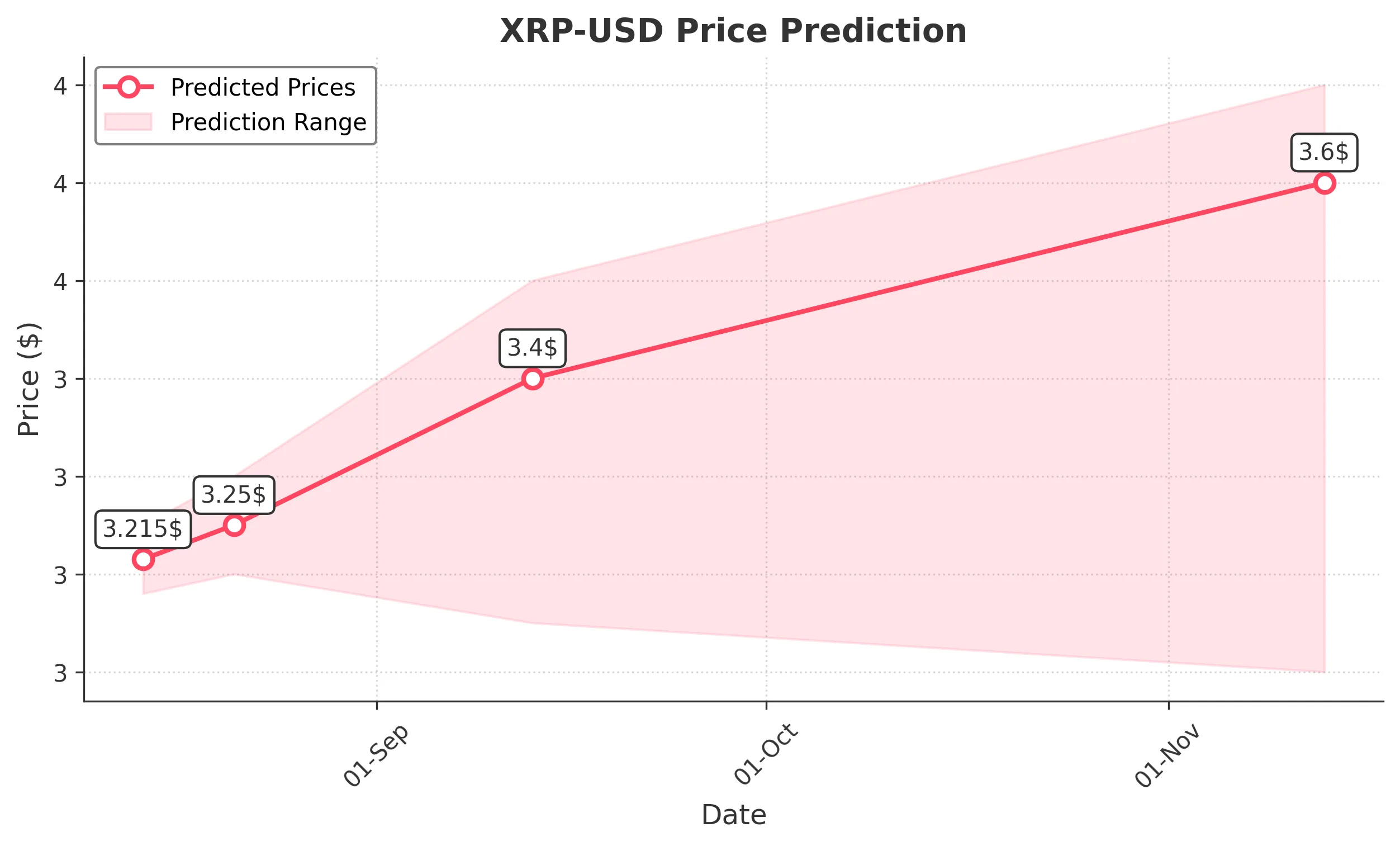

Target: August 14, 2025$3.215

$3.22

$3.25

$3.18

Description

The price is expected to stabilize around 3.215, supported by recent bullish momentum and a strong closing pattern. RSI indicates overbought conditions, suggesting a potential pullback. Volume remains high, indicating strong interest.

Analysis

XRP has shown a bullish trend over the past three months, with significant support at 3.00 and resistance around 3.50. Recent candlestick patterns indicate bullish sentiment, but RSI suggests caution due to overbought conditions.

Confidence Level

Potential Risks

Potential volatility due to market sentiment shifts or external news could impact the prediction.

1 Week Prediction

Target: August 21, 2025$3.25

$3.215

$3.3

$3.2

Description

Expecting a slight upward trend to 3.250 as bullish momentum continues. However, the RSI indicates potential overbought conditions, which could lead to a pullback. Watch for volume spikes that may signal reversals.

Analysis

The stock has been in a bullish phase, with strong volume supporting upward movements. Key resistance at 3.30 may limit gains, while support at 3.20 is crucial for maintaining upward momentum.

Confidence Level

Potential Risks

Market corrections or negative news could lead to unexpected price movements.

1 Month Prediction

Target: September 13, 2025$3.4

$3.25

$3.5

$3.15

Description

Anticipating a gradual rise to 3.400 as bullish sentiment persists. Fibonacci retracement levels suggest potential resistance at 3.50. Watch for volume trends that could indicate market sentiment shifts.

Analysis

XRP has shown resilience with a bullish trend, but the RSI indicates potential overbought conditions. Key support at 3.20 and resistance at 3.50 will be critical in determining future price movements.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact the price trajectory.

3 Months Prediction

Target: November 13, 2025$3.6

$3.4

$3.7

$3.1

Description

Expecting a longer-term bullish trend towards 3.600, supported by strong market sentiment. However, potential resistance at 3.70 could limit gains. Monitor for any bearish signals that may arise.

Analysis

The overall trend remains bullish, but the market is showing signs of volatility. Key support at 3.20 and resistance at 3.70 will be crucial. External factors, including regulatory news, could significantly impact price movements.

Confidence Level

Potential Risks

Long-term predictions are subject to higher uncertainty due to market dynamics and potential regulatory changes.