XRP Trading Predictions

1 Day Prediction

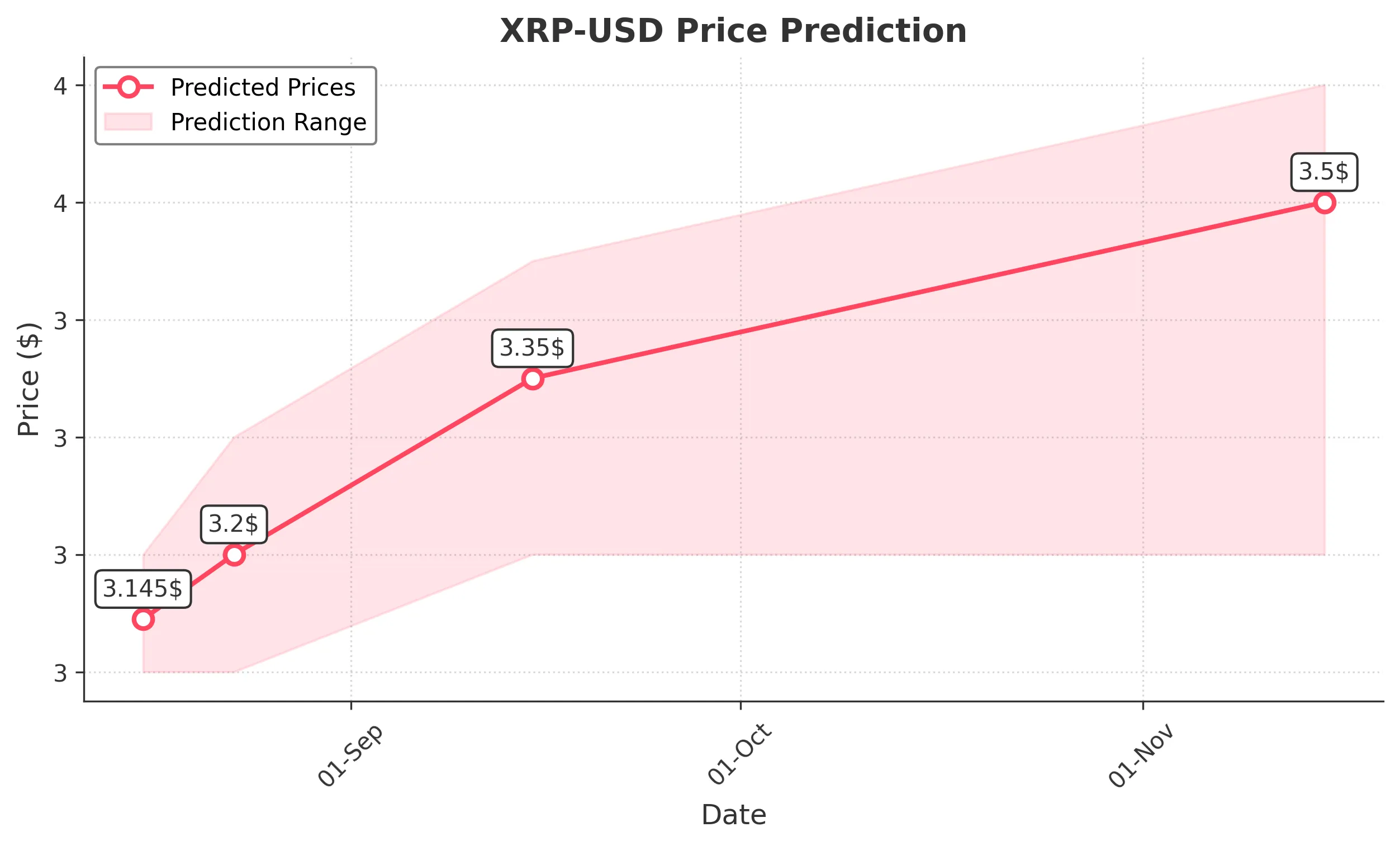

Target: August 16, 2025$3.145

$3.138

$3.2

$3.1

Description

The price is expected to stabilize around 3.145, supported by recent bullish momentum and a slight upward trend in volume. RSI indicates overbought conditions, suggesting potential pullback risks.

Analysis

XRP has shown a bullish trend over the past three months, with significant resistance at 3.55 and support around 3.00. Recent volume spikes indicate strong buying interest, but RSI suggests overbought conditions, indicating potential for a pullback.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 23, 2025$3.2

$3.145

$3.3

$3.1

Description

Expecting a slight increase to 3.200 as bullish sentiment continues. However, the RSI indicates potential overbought conditions, which could lead to a correction.

Analysis

The stock has been in a bullish phase, with key resistance at 3.55. The recent price action shows strong buying volume, but the RSI indicates overbought conditions, suggesting a possible pullback in the near term.

Confidence Level

Potential Risks

Potential market corrections and external factors could lead to unexpected price movements.

1 Month Prediction

Target: September 15, 2025$3.35

$3.2

$3.45

$3.2

Description

Predicted to rise to 3.350 as bullish momentum persists. However, the market may face resistance at 3.55, and profit-taking could lead to volatility.

Analysis

XRP has shown strong upward momentum, with significant support at 3.00. The MACD indicates bullish momentum, but the RSI suggests potential overbought conditions, which could lead to corrections.

Confidence Level

Potential Risks

Market sentiment and macroeconomic factors could influence price direction.

3 Months Prediction

Target: November 15, 2025$3.5

$3.35

$3.6

$3.2

Description

Expecting a gradual increase to 3.500, driven by sustained bullish sentiment. However, resistance at 3.55 may limit upside potential.

Analysis

The overall trend remains bullish, with key support at 3.00 and resistance at 3.55. The ATR indicates increasing volatility, and the market sentiment remains positive, but caution is advised due to potential corrections.

Confidence Level

Potential Risks

Long-term market trends and external economic factors could impact the prediction.