AI Trading Forecast Analysis - April 6, 2025

AI Trading Forecast Analysis - April 6, 2025

AI Trading Forecasts – April 6, 2025

This report analyzes the AI-generated predictions for April 6, 2025, as published on AITradingPredictor.com. The focus is on four key markets: AUD/USD, Bitcoin (BTC/USD), Ethereum (ETH/USD), and XRP.

AUD/USD Forecast

The AI model suggests a short-term bearish sentiment with minor intraday gains. While the one-day outlook is slightly negative, weekly and monthly forecasts show signs of a slow recovery. Over a three-month period, a bullish shift is projected, with resistance near 0.64. Market confidence seems to be strengthening gradually, but caution is still advised due to global economic uncertainty.

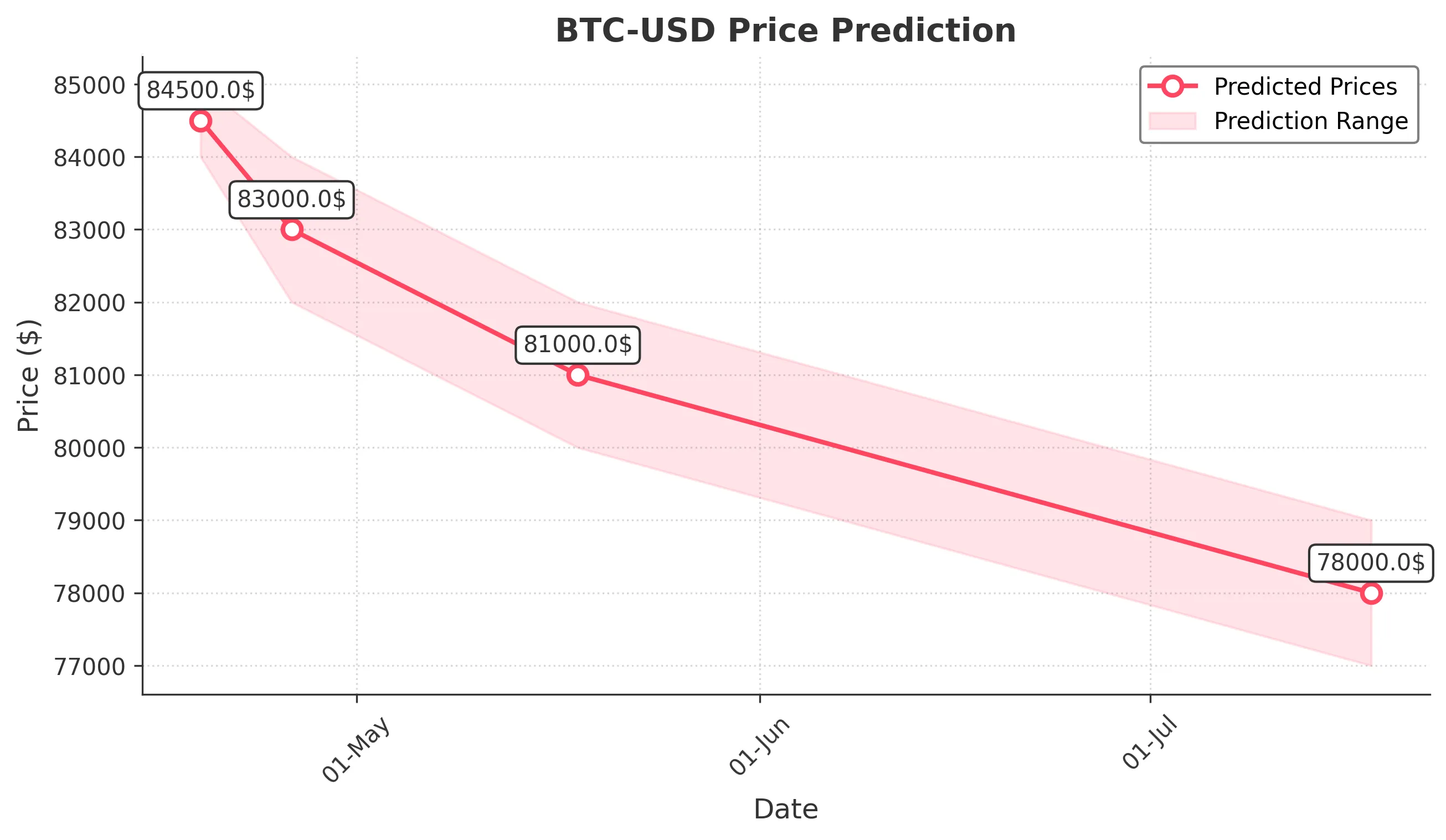

BTC/USD Forecast

Bitcoin is undergoing consolidation. Daily forecasts point to minor fluctuations, while weekly predictions lean slightly bearish. The model anticipates a possible recovery by early May, with a three-month outlook aiming for a return to $90,000. Technical indicators such as RSI and MACD suggest cautious optimism, though volatility remains a significant factor affecting sentiment.

ETH/USD Forecast

Ethereum shows a stabilizing pattern around the $1,800 level. AI projections hint at a steady climb over the next week and month. If market momentum increases and oversold conditions improve, ETH may reach $1,950 or more by July. Analysts should monitor RSI and volume closely, as they indicate growing investor interest despite recent declines.

XRP Forecast

XRP exhibits a cautious uptrend after a period of decline. The daily and weekly forecasts indicate a mild recovery, with resistance near $2.20. The monthly outlook is more optimistic, projecting a climb toward $2.30. Over three months, a possible target of $2.50 is forecasted, contingent on improved sentiment and reduced regulatory risk. Still, external events remain a critical factor that could affect volatility.

Conclusion

Across all four assets, AITradingPredictor’s models reveal a cautiously optimistic stance moving into Q2 2025. While short-term instability remains present, medium to long-term projections suggest potential for recovery and growth—especially in crypto assets. Traders should consider these insights alongside their own technical and fundamental analysis.